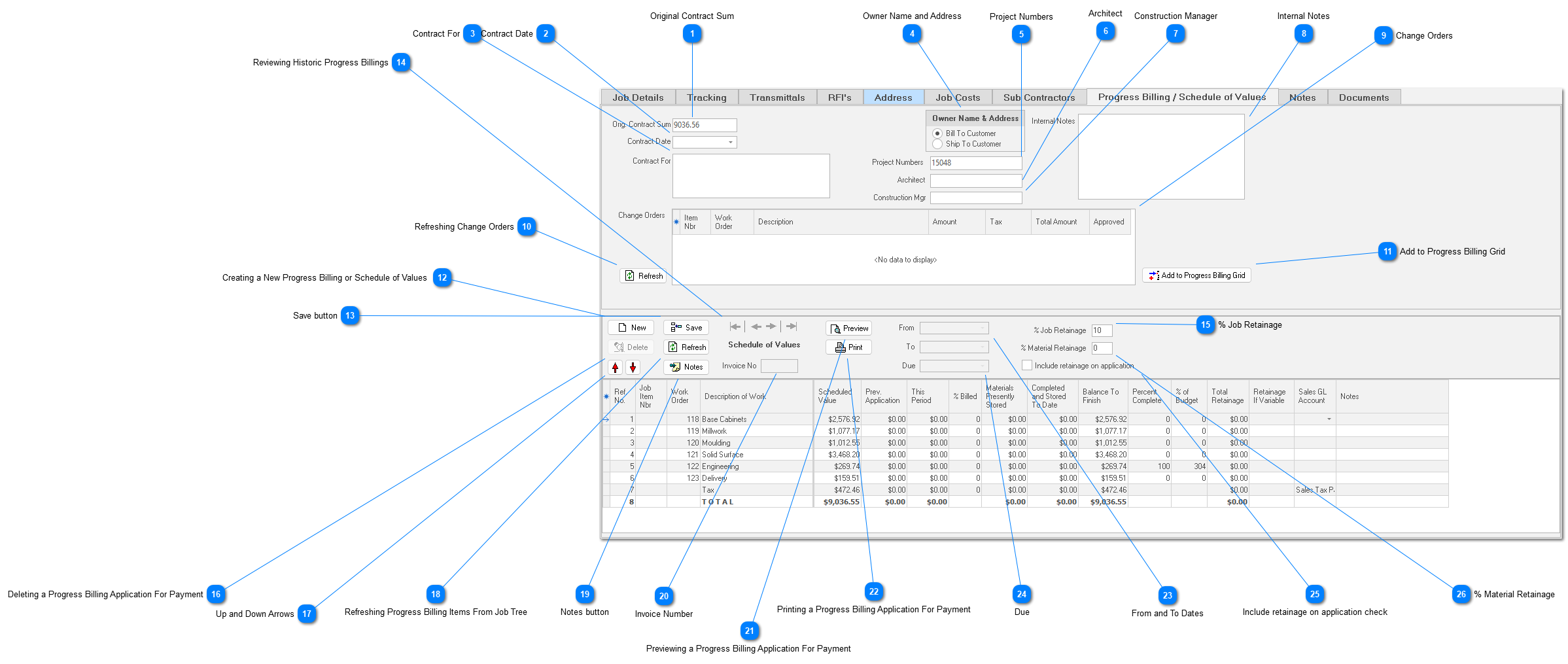

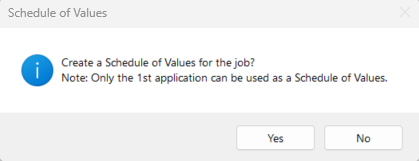

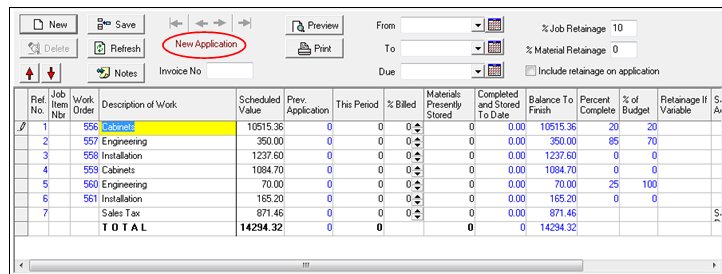

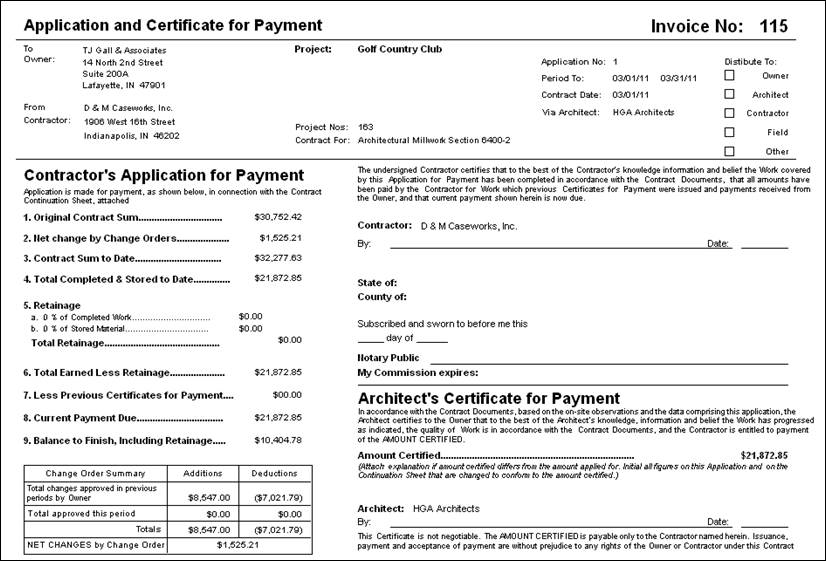

Creating a New Progress Billing or Schedule of Values To create a new progress billing, click the “New” button. The first time you click “New” for a given job, ShopPAK displays the following message:

If you want to send your customer an initial Schedule of Values, click Yes. ShopPAK always identifies this occurrence of your billings accordingly -> Schedule of Values.

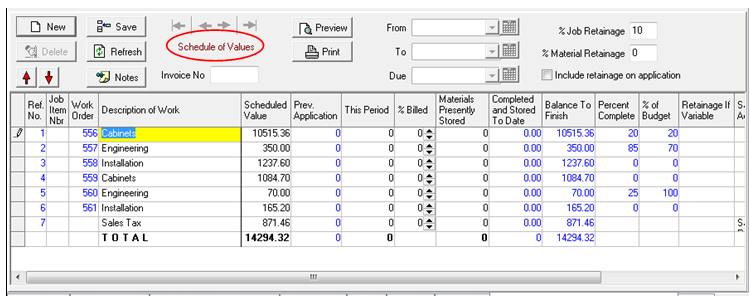

The Schedule of Values doesn’t have a From, To, or Due date. Moreover, it will never have an invoice number. Never update ‘This Period’ or ‘% Billed’ on the Schedule of Values.

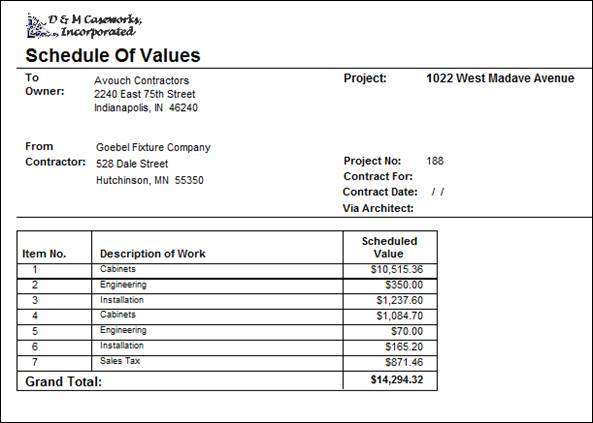

To generate the Schedule of Values, click either the Print or Preview buttons:

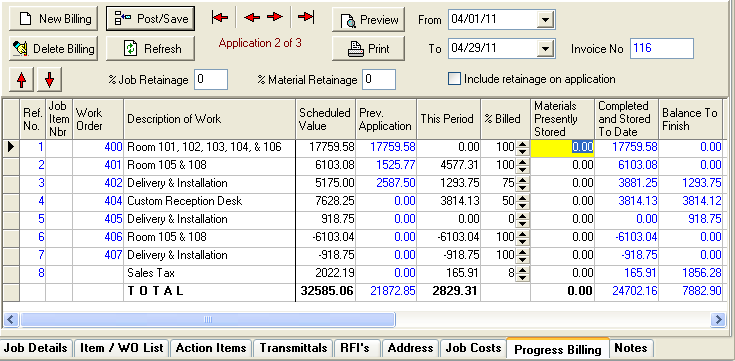

If you didn’t elect to create a Schedule of Values when your first clicked “New”, or the next time you click the “New” button, ShopPAK displays -> New Application. This tells you that this progress billing instance is going to be an actual application for payment.

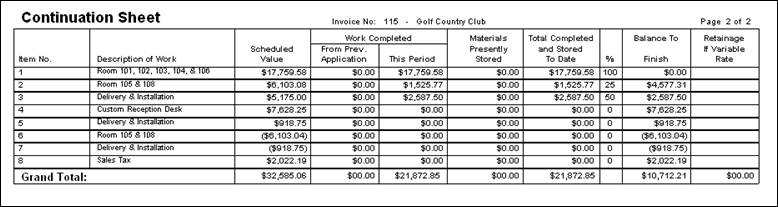

Initial Application Items

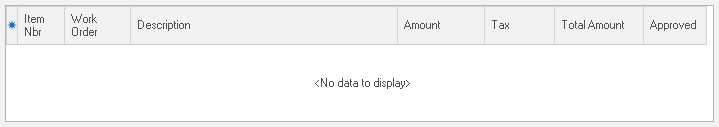

If you have any Job Items or Work Orders that have been flagged for inclusion on a progress billing application, ShopPAK adds them as application items along with their scheduled value.

Sales Tax

If you are collecting sales tax, ShopPAK automatically calculates and adds “Sales Tax” as the last application item.

Determing the New Progress Billing Amounts

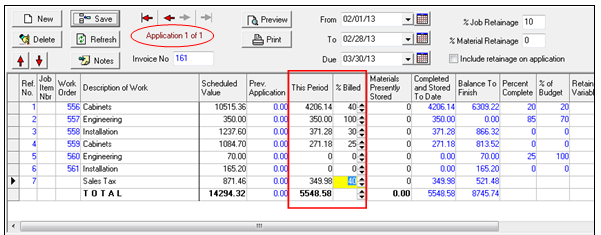

For each application item that has ‘billable’ labor and/or material, adjust either the “This Period” amount or the “% Billed”.

This Period

If you prefer entering a dollar amount, simply enter the dollar amount into “This Period” and click Enter or tab out of the cell. ShopPAK automatically adjusts the application item’s “% billed”, “Completed and Stored to Date” amount, and “Balance To Finish” amount. It also updates the sales tax and total rows accordingly.

% Billed

If you prefer to work in percentages, simply enter the percentage that should be billed into “% Billed” and click enter or tab out of the cell. ShopPAK automatically adjusts the application item’s “This Period” amount, “Completed and Stored to Date” amount, and “Balance To Finish” amount. It also updates the sales tax and total rows accordingly.

Percent Complete / Percent of Budget

If the application item is based on a work order or job item (as they are in our example), ShopPAK includes both the “Percent Complete” and “Percent of Budget” percentages for the work order / job item. Use these percentages to help you determine the correct “Percent Billed” percentage. The “Percent Billed” should be close to the progress tracking percentages, however, due to the fact that you are projecting a relative completion percentage and there may be issues with collecting payment from the GC, you’ll often enter “Percent Billed” percentages that are greater than either of ShopPAK’s progress tracking percentages.

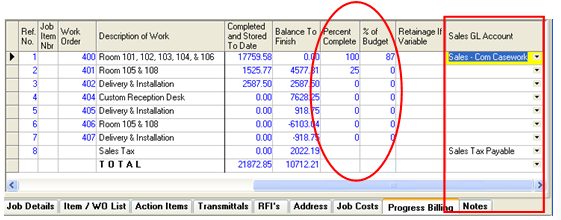

Sales GL Account

If the application item is based on a work order or job item (as they are in our example), and the work order or job item has a “Sales GL Account”, ShopPAK automatically fills in the “Sales GL Account”. If you export the invoice to an accounting package, the sales GL account is usually required. If a sales GL account is not present, you can add it manually by selecting the correct GL account code from the pick list.

Line Item Notes

You can also add an internal 'informational' note to a given line item by typing the note into the application item's notes cell. These notes don't print anywhere. They are used as needed by the person creating the AIA progress billings.

|